The DeFi world can feel like the Wild West. On one hand, there are incredible opportunities — groundbreaking protocols, creative tokenomics, and projects genuinely pushing financial innovation forward. On the other, there’s a steady stream of schemes designed to separate you from your hard-earned crypto.

Over the past few weeks, I’ve dug into a wide variety of projects. While I won’t name any specific ones here (it’s important to be fair until a rug is confirmed), I’ve noticed the same warning signs cropping up again and again. Consider this a quick guide to spotting trouble before it drains your wallet.

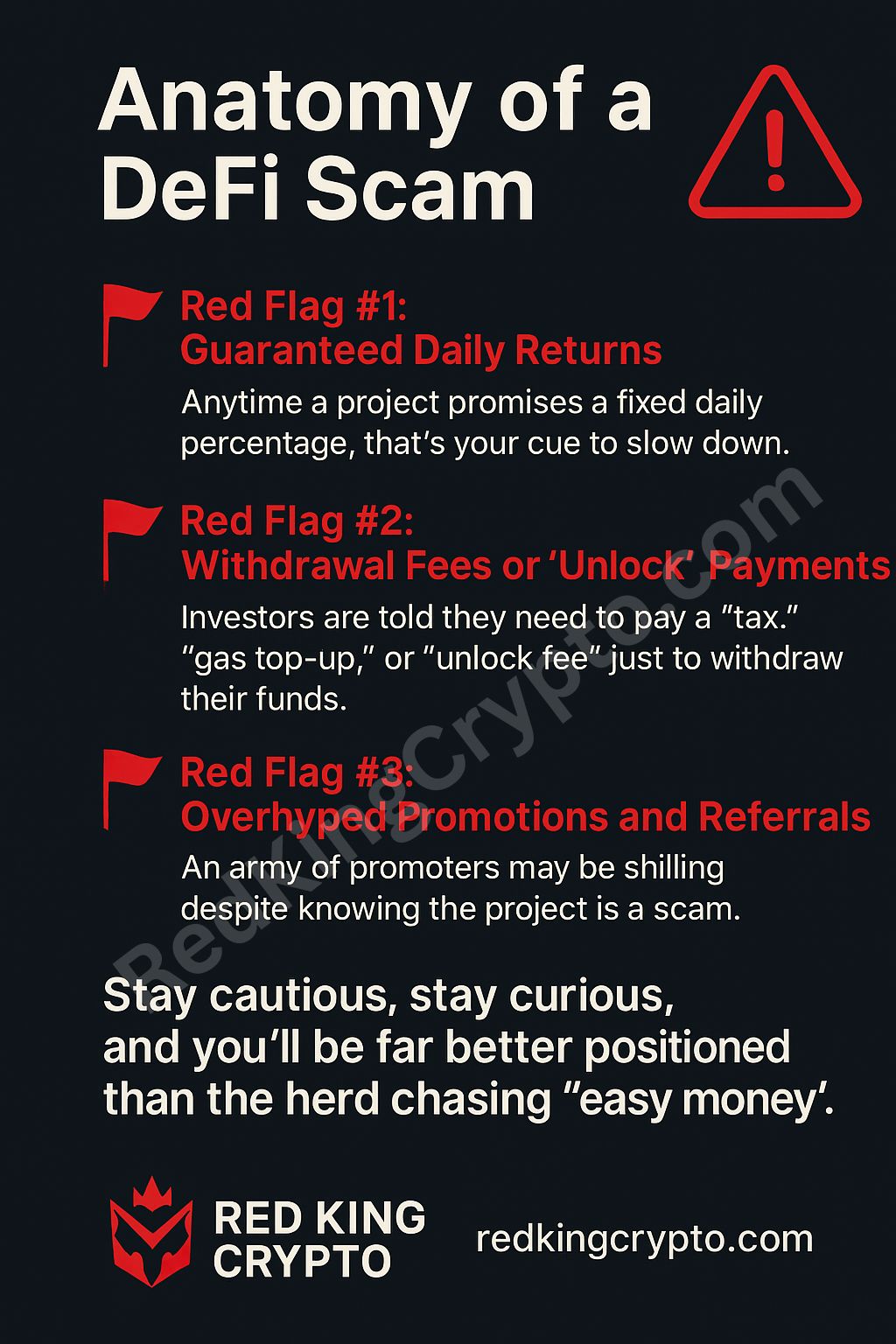

🚩 Red Flag #1: Guaranteed Daily Returns

Anytime a project promises a fixed daily percentage — “1.5% daily,” “double your money in X days,” or charts showing your tokens magically compounding — that’s your cue to slow down. Legitimate DeFi protocols rarely (if ever) guarantee returns because markets are inherently volatile. If a project markets itself as “risk-free” with daily compounding growth, chances are the math works only as long as new deposits keep flowing in. That’s not sustainable.

🚩 Red Flag #2: Withdrawal Fees or “Unlock” Payments

Another recurring scam tactic is the dreaded “extra payment” request. Investors are told they need to pay a “tax,” “gas top-up,” or “unlock fee” just to withdraw their funds. Once you send that extra payment? The goalposts shift again, and your money is gone. In legitimate DeFi platforms, once tokens are staked, you can unstake them subject only to on-chain gas fees — not arbitrary withdrawal taxes.

🚩 Red Flag #3: Overhyped Promotions and Referrals

One of the most telling signs is the army of promoters you’ll find on YouTube, TikTok, and Telegram channels. Many of these promoters know full well that the project they’re shilling looks suspicious. But here’s the catch: they don’t care. Their income isn’t from investing — it’s from referral commissions. As long as new money comes in through their links, they profit… even if the protocol collapses tomorrow. When you see a project more aggressively marketed through affiliate links than audited technical docs, it’s time to take a step back.

So Where Do You Look Instead?

My goal definitely isn’t to scare people away from DeFi altogether — there are genuine projects building long-term value. I wrote about a few options in my September DeFi round-up.

For example, Disciple Verse, an NFT quiz game, stands out for its transparency and mission-driven approach. It doesn’t rely on gimmicky promises of guaranteed daily income. Instead, it’s structured around fun gameplay, community engagement, and a real product you can interact with today. The NFTs are already available, on a sliding scale which means the price increases as more get sold, this is to reward the earliest buyers. You can get the NFTs on the Manifold Marketplace here. The project is run on the Base chain, via MetaMask, so the gas fees are extremely cheap.

I’ve also been using Pryzm for almost a year now and I’ve already started taking profits on my staking / liquidity contributions. Pryzm gives you “Photons” for holding or staking certain Cosmos-ecosystem tokens (ATOM, INJ, etc.), plus bonuses for providing liquidity and delegating to their validator. The accrual of rewards has been consistent so far, and I have made multiple withdrawals without any problems. For me, it ranks among the more credible of the smaller DeFi plays I’m tracking.

Fire Faucet is one I’ve just started using recently, but they have been around for quite a while. This one entails doing microtasks and earning micro amounts of crypto.

Other legitimate options exist too — projects that build slowly, have open documentation, and don’t rely on armies of referral marketers to spread the word. Those are the ones worth your attention.

Final Thoughts

DeFi has incredible potential, but separating innovation from imitation is crucial. If you remember nothing else, remember this:

- If it guarantees returns, it’s likely too good to be true.

- If you’re asked to pay extra just to withdraw, walk away.

- If the main push is referrals over real utility, it’s not built to last.

Stay cautious and you’ll be far better positioned than the herd chasing “easy money.”

Remember, this is just my take on things, and the crypto world is as unpredictable as it gets. So, do your research, stay informed, and make decisions you’re comfortable with.

As always this is not financial advice, just findings based on my research. Remember to only use risk capital.

Additional Things to Note:

- You can join my Telegram group here or connect with me on Twitter here or follow me on YouTube here.

- Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- These defi projects are all high risk and high reward, only use risk capital and be careful.

[…] pattern of lies dressed up as “investment opportunity.” I tried to warn you. In my recent piece “Anatomy of a DeFi Scam” I laid out the three red flags that scream danger — guaranteed returns, withdrawal taxes/unlock […]