Earn Income with a Rare Combination of Transparency and Community

f you’ve followed my previous articles — such as “Anatomy of a DeFi Scam” — you’ll know how much I value transparency. It’s possibly the single most important marker of a project’s long-term integrity.

One of the things I personally appreciate about Monstro is its Discord community. It’s consistently active, full of feedback, updates, and genuine engagement — the kind of open communication that actually builds trust. The team answers questions directly, posts regular updates, and the tone is one of accountability rather than radio silence.

That kind of culture doesn’t happen by accident; it’s a reflection of the team’s attitude: they’re building in the open and staying connected to the people who use the platform.

Monstro in a Nutshell

Monstro is a DeFi ecosystem built on the Base network that combines smart, yield-earning products with a refreshing dose of fun. It offers investors a range of options, from stable, blue-chip pools to high-risk, high-reward opportunities, all paying out in weekly USDC rewards.

Add in gamified NFTs, a vibrant community, and a transparent team, and you’ve got a project that’s re-energizing the DeFi world, especially since so many people have been burned by chasing scams through promises of fast riches.

A Platform Built on the Base Network

Monstro operates on Base, of which I am a big fan. Base offers lower gas fees, faster transaction speeds, and a strong link to one of the most reputable names in crypto (Coinbase). The move to Base isn’t just a technical decision — it’s a statement of intent. By building in an efficient and trusted environment, Monstro is removing one of DeFi’s biggest barriers for everyday users: cost.

With transaction fees often just a fraction of what you’d pay on Ethereum mainnet, investors can stake, withdraw, and move funds without watching their profits disappear to gas costs.

This was a major issue for me (and many others) in the early days of playing Axie, where Ethereum’s gas fees would take a major chunk of a player’s profits. It’s part of what makes Monstro so accessible — and why the community has grown so quickly. It’s also a big reason why I support another NFT project, Disciple Verse, as it is also built on the Base network.

What Makes Monstro Stand Out

The DeFi landscape is full of projects that promise returns, but few manage to build something fun, transparent, and actually sustainable. Monstro manages to balance all three.

What Monstro Offers:

Monstro isn’t a single staking pool or farming opportunity — it’s an entire ecosystem designed to suit different risk profiles. Here are some of the opportunities they offer:

Pokz: high-risk, high-reward

Pokz is designed for the thrill-seeker: gamified, speculative, and capable of delivering eye-catching returns. Amazingly, the majority of people who invested in the Pokz launch in 2025 have already hit ROI and are now receiving free passive income going forward which is a real win for early participants.

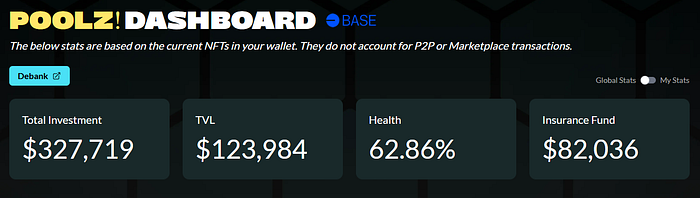

Poolz: stable, blue-chip yield farming

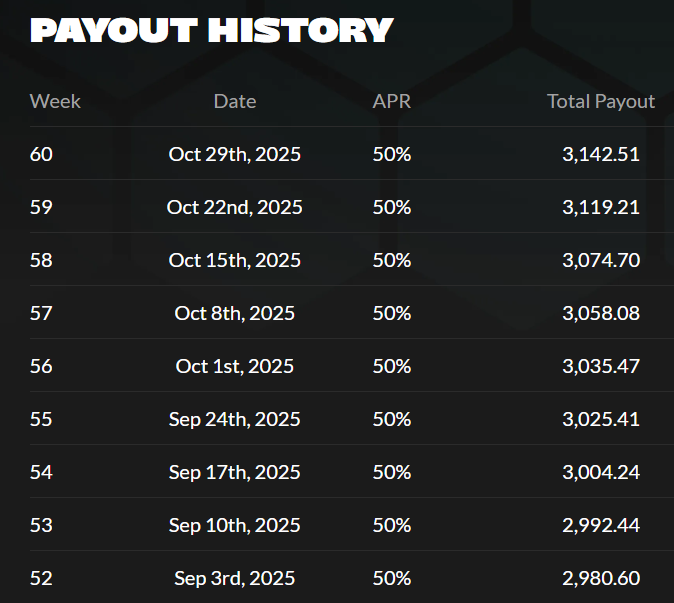

Poolz is blue-chip-oriented and pays weekly USDC rewards. Poolz has paid consistent weekly APRs (50% APR weeks over many cycles) and has a long payout history that demonstrates durability through market cycles. The Monstro dashboard makes it easy to check payout history and the week-by-week performance.

Farmz: long-running farming & payouts

Farmz was an early open farming initiative and has delivered meaningful distributions to participants. It has a very low entry threshold (minimum investment of 100 USDC) while upper tiers in the ecosystem (such as $10K vaults, $50K fortresses and $100K kingdom tiers) unlock additional perks for larger investors — a clear structure to support both retail and institutional-size participants.

Golemz: A sold-out, zero-impermanent-loss product with a 100% target APR and weekly payouts.

Moonbagz: A narrative-driven NFT series on BNB Smart Chain, where each NFT represents a portfolio of altcoins and earns holders regular USDC distributions.

Degenz (PvP): a clever safety net

Degenz was Monstro’s PvP staking mechanic. Importantly, the team points out that every player who didn’t finish “in profit” still received a safety net that yields on 30% of their deposited value, and those Safety Net NFTs are still paying weekly and are visible in the Farmz dashboard. That means even the “losers” from the PvP era still retained ongoing yield which is an elegant built-in consumer protection and a real differentiator.

This range of offerings shows that Monstro isn’t just about one product launch, it’s building a layered ecosystem with different options.

A Look at the Token and Economics

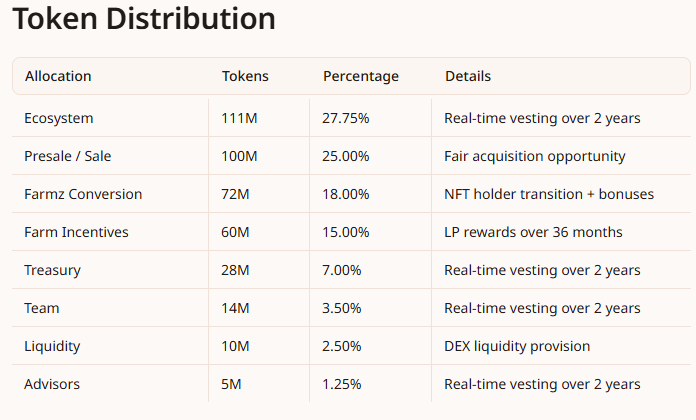

Without diving too deep into the spreadsheets, the upcoming $MONSTRO token is at the foundation of the entire ecosystem.

While the presale date has not yet been announced, the groundwork is already well underway, with the team choosing to wait for optimal market conditions before going live. This patient, deliberate approach shows a maturity that many projects lack, prioritizing stability and sustainability over hype-driven launches.

$MONSTRO will feature a deflationary model with several built-in scarcity mechanisms. There will be no minting function, and parts of the supply can be reduced through mechanisms such as early-withdrawal penalties and unclaimed vesting tokens. This structure encourages long-term participation and ensures that loyal holders benefit as the ecosystem grows.

What stands out most is how $MONSTRO isn’t being rushed into the market. The team is focused on refining every piece of the system, from pool mechanics to audit readiness, so that when the presale opens, it launches into a solid, functional ecosystem rather than an unfinished experiment. That kind of patience and preparation speaks volumes about their long-term vision.

Security and the Hashlock Audit

Security is always the elephant in the room in DeFi, and Monstro has addressed this head-on. The team has officially partnered with Hashlock, one of the most respected Tier-2 blockchain security firms. Hashlock has worked with a long list of major DeFi protocols, and their audits are known for thoroughness and clear reporting.

This audit not only ensures Monstro’s upcoming contracts are secure and optimized, but it also opens the door to future collaborations, networking with venture capital partners, and co-marketing opportunities.

Smart Yield Router and free tools

Monstro also builds practical, community-requested tools. A standout is the Smart Yield Router which is a free, user-friendly utility intended to take idle BTC/USDC/ETH and put it into very low-risk lending strategies (zero-risk lending profile in the team’s description) for modest APY with instant withdrawals and no fees.

That lets users park spare capital and rotate it back into higher-earning Monstro products when they want.

Why Monstro Deserves Attention

Monstro’s combination of weekly USDC payouts, clear product variety, and Base-level efficiency makes it a standout project in today’s crowded DeFi market. But beyond the technology and tokenomics, it’s the approach that makes it special: fun, rewarding, inclusive and transparent.

Many DeFi projects struggle to connect with their community or build real trust. Monstro, on the other hand, is doing the opposite; engaging, educating, and rewarding its users week by week. It’s this consistency that gives me confidence that Monstro isn’t a short-term experiment, but a platform that’s here to evolve.

And There is Still More to Come…

Monstro’s roadmap is deliberately agile, but it teases several big ideas: more product innovation, tool enhancements, and on-chain GameFi experiences that will tie the ecosystem together.

If Monstro delivers game mechanics that interlock with Farmz/Pokz/NFT utility, it could create new reward loops that keep users engaged and funds productive. The roadmap page frames this as a community-driven evolution, which is precisely how you want a project like this to mature.

Final Thoughts

DeFi always has an element of risk, and as always, I encourage you to do your own research, but if you’re exploring the Base network and looking for a platform that’s combining smart contracts with a little personality, Monstro is definitely worth a look.

If you enjoyed this article, or found some value in it, please give it some claps.

Additional Things to Note:

- Other great projects I am in at the moment are Pryzm and Disciple Verse.

- You can join my Telegram group here or connect with me on Twitter here or follow me on YouTube here.

- Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- This has been a sponsored post.

- These defi projects are all high risk and high reward, only use risk capital and be careful.