I tried to warn you.

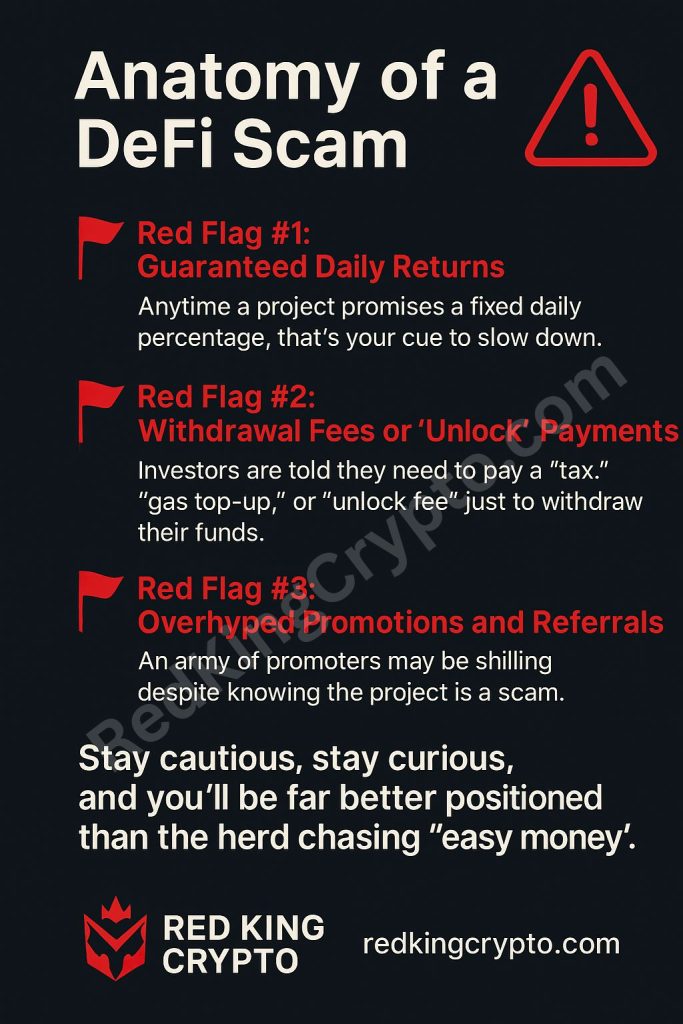

Sickening. Disgusting. That’s how I felt when I heard the reports come in: investors waking up to drained accounts, dead contracts, and a familiar pattern of lies dressed up as “investment opportunity.” I tried to warn you. In my recent piece “Anatomy of a DeFi Scam” I laid out the three red flags that scream danger — guaranteed returns, withdrawal taxes/unlock fees, and armies of referral promoters. Now we’re apparently watching those exact warning signs play out in real time.

Quick note before we go further: I am writing this from the position of someone who has seen the community messages and investor reports bemoaning Peak Capital for draining their funds and rug-pulling the project. I’m publishing this because victims need their voices amplified and because the pattern here is textbook — if you have been scammed let me know so we can spread the message.

You can join my Telegram group here .

How Peak Capital looked before the fall — and why it was a red flag

Before investors lost money, Peak Capital advertised mechanics that read like a dream and a warning wrapped into one. Here’s verbatim what they promised:

PeakCapital promises —

🔹First 20 days you get profit as 0.75% per day

🔹Next 10 days (21–30) 1.5% per day

🔹Next 20 days (31–50) 2% per day

🔸No reset, no reduction — Withdraw profits anytime with zero withdrawal tax

🔸Withdraw your initial anytime — unstaking fees reduce as days increase

“Great mechanics — No tension — Relax and Earn Profit.”

If that language looks familiar, it’s because it matches the classic “too-good-to-be-true” playbook: fixed daily returns, guaranteed access to principal, and a promise that the system never reduces payouts. Those are exactly the sorts of promises I told readers to be wary of in “Anatomy of a DeFi Scam.” Fixed daily returns and guaranteed principal make the math work only if a steady stream of new deposits keeps arriving — not from real revenue or legitimate trading. That structure has failed time and again.

The rug pull (as reported by victims)

Community posts, private messages, and investor screenshots started to show a painfully familiar sequence:

- Withdrawal requests that either timed out or were blocked.

- Support channels that went quiet or demanded “verification fees.”

- Contract or liquidity pools that were emptied, leaving token prices to crash.

- Promoters quickly moving on to the next project and recycling the same promo language.

When withdrawals fail en masse and liquidity is drained, the outcome is the same: funds are gone and messages vanish.

The promoters — the real moral outrage

What makes this particularly vile is not only the act of theft, but the ecosystem that enabled it. I’ve spent years watching crypto communities. Seasoned promoters — people who know how projects should look, who know audit schedules and what real tokenomics look like — were the loudest cheerleaders for Peak Capital. They shared slick videos, affiliate links, and testimonials designed to convert viewers into depositors. Many of these promoters likely recognized the red flags. But did that stop them? No.

They didn’t apologize when funds were lost. They didn’t pause and ask for evidence. They pivoted — like clockwork — to the next shiny dapp, offering new referral codes and trotting out the same old promises. The behaviour can be summarized in three ugly words: optics, clicks, commissions. As long as referral income flows, accountability takes a back seat. This is not a market — it’s predation.

(If this article resonates with you please give it some claps at the bottom).

Ask yourself: when your friends lose thousands and the person who sent them the referral link moves on to the next scheme without remorse, what does that tell you about their priorities? Does the profit excuse the harm? To me the answer is obvious — and infuriating.

Look at the copy-paste playbook — RoastedBeef is next

Predictably, the follow-up project being pushed by many of the same channels is ***********. The promo template is eerily familiar:

These are the promises of the new platform —

- 5% per day profit

- Immutable Audited Smart Contract

- Fund is locked

- Join Early — 10% referral bonus

- Break even on 20th day — Daily Withdraw Profit

- Compounding option available

Sound familiar? Copy, paste, rinse, repeat. “Immutable audited smart contract” is a favorite claim — auditors can be faked, reports can be doctored, and “locked” funds can be handled in ways that still funnel value to owners. Coupling that with immediate referral incentives is the exact combination that creates a feeding frenzy: it converts trust into deposits and shortens the window between hype and exit.

Why these promises are dangerous — the mechanics behind the scam

A few technical notes for readers who want to understand why the schemes collapse:

- Fixed daily rates (like 0.75% → 2% per day) imply extremely large annualised yields. Real revenue sources that support those yields are almost never present.

- Zero withdrawal tax + instant principal withdrawals is a social-engineering hook: it reassures depositors and keeps money flowing early — but when liquidity is drained, those promises mean nothing.

- Referral commissions create perverse incentives. Promoters can make a quick, substantial commission on recruiting new stakers while not bearing the downside risk themselves. That misalignment is what turns marketing into weaponized recruiting.

What this means for the community

This moment should be a call to action. We can respond by:

- Sidelining projects that offer guaranteed daily yields and reward heavy referral mechanics.

- Looking for projects that don’t make huge promises, but genuinely want to build something either fun (games, entertainment) or profitable over the long run (slow-growing investment platforms). For me personally at the moment, that means projects like Disciple Verse and Pryzm, both of which I have invested in.

- Calling out promoters who repeatedly push clearly problematic projects; public accountability matters.

Crypto should be for builders, not bandits. When people lose their savings to schemes circulated by supposed “crypto insiders,” it destroys trust that honest projects need to survive.

Final thoughts — I tried to warn you

If you read my last piece — “Anatomy of a DeFi Scam” — you’ll remember I highlighted exactly the three red flags that led us here. I wrote that article to help readers spot the signs before disaster struck. Now we must turn warning into action: document, expose, and push for real accountability.

To the promoters who chased referral cash while their audiences burned — you owe people more than silence, not just the next referral link posted five minutes after the last collapse.

Remember, this is just my take on things, and the crypto world is as unpredictable as it gets. So, do your research, stay informed, and make decisions you’re comfortable with.

As always this is not financial advice, just findings based on my research. Remember to only use risk capital.

Additional Things to Note:

- You can join my Telegram group here or connect with me on Twitter here or follow me on YouTube here.

- Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- These defi projects are all high risk and high reward, only use risk capital and be careful.