I like to do a monthly round-up of DeFi projects I’m exploring—some solid, some experimental, and some outright degen plays. None of this is financial advice (DYOR always), but hopefully it gives you a feel for what’s out there in the ever-expanding crypto jungle.

Zater Capital

Zater Capital positions itself as a DeFi yield platform with a focus on automated strategies.

The pitch is simple: you deposit stablecoins or major cryptos, and they farm across multiple chains for you. Their site looks polished, and they advertise sustainable yield rather than eye-popping APYs.

My take: if they can maintain transparency and show real strategies behind the scenes, this could be a safer mid-risk play. I’ll be watching closely for verifiable audits and proof-of-reserves. Check out Zater Capital here.

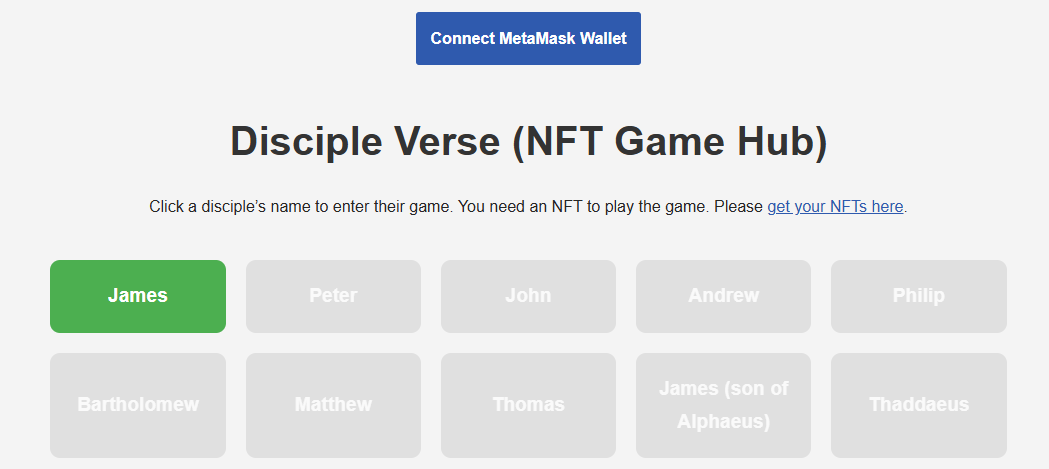

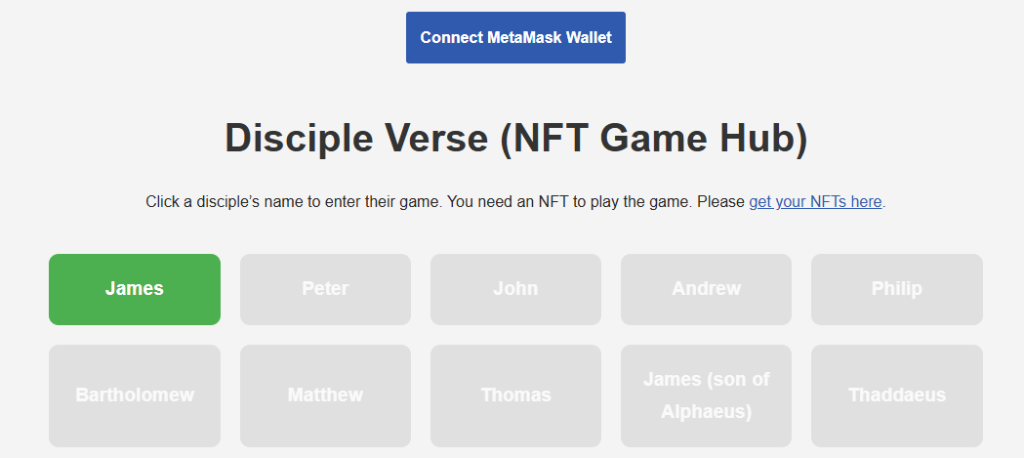

Disciple Verse

Disciple Verse is building a suite of mini-games and NFT utilities around the theme of the 12 disciples. At the moment, the “James” game is live, where NFT holders unlock the first game which is trivia-based and your score goes to the leaderboard. You can play once every 20 hours, and at the end of the season you receive rewards in tokens.

It’s still extremely early days (still in Alpha-testing phase, but the game is playable), but what I like is the clear roadmap: more games (Andrew fishing game, Judas snake game, etc.), and the NFT-based access. This isn’t a typical yield-farming play—it’s more of a gamified DeFi-NFT experiment.

I see it as a fun side project with upside if adoption grows. The initial NFTs are being sold on a discounted sliding scale with the prices starting at a super low price currently, and increasing after every ten NFTs sold, so get one, or a few, now while they are at their lowest price. Amazingly there are fewer than 80 NFTs available for the first game so scarcity will come into play at some stage. Check out Disciple Verse here.

Gem Hive

GemHive, a gamified yield-farming platform that use blends locked staking with user-driven growth. It offers eight tiered investment plans, each with different lock-up periods and attractive daily returns ranging from about 0.8% to 2.4%.

You’ve also got flexible reward options—either claim your full earnings or opt for an 80/20 split that automatically reinvests a portion, plus manual reinvestment is supported once per day. On top of that, there are milestone-based bonuses, and transparent fee disclosures, all wrapped in an interface that tracks both user and global TVL for community visibility.

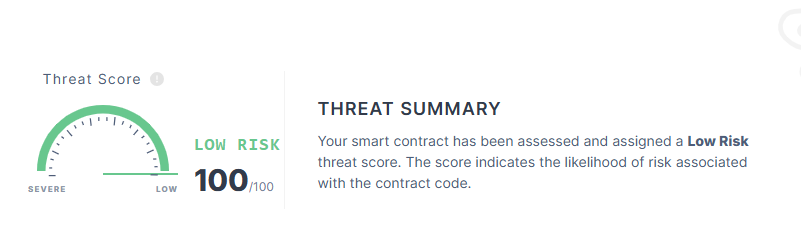

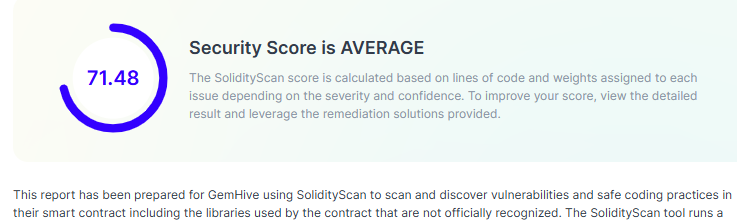

It has been audited by Solidity Scan. It’s more structured than your average “degen” yield app, still high-risk in my opinion, but is designed with layers and incentives that aim to give “network builder rewards.” Check out GemHive here.

Fire Faucet

If you’re looking for micro-earning opportunities, FireFaucet has been around for a while.

It’s a faucet site where you can auto-claim small amounts of crypto by completing tasks,

watching ads, or engaging in the community.

It’s not going to make you rich, but it’s a cool way for beginners to collect small amounts of

BTC, ETH, or altcoins. I’d put this in the “entry-level” category—great for people who want to

dip their toes into crypto without spending money. Check out Fire Faucet here.

Final Thoughts

This month’s line-up has quite a range, some look promising, some are definitely speculative.

Remember, this is just my take on things, and the crypto world is as unpredictable as it gets. So, do your research, stay informed, and make decisions you’re comfortable with.

As always this is not financial advice, just findings based on my research. Remember to only use risk capital.

Additional Things to Note:

- You can join my Telegram group here or connect with me on Twitter here or follow me on YouTube here.

- Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- These defi projects are all high risk and high reward, only use risk capital and be careful.