Choose your Staking Duration. Project is Triple-Audited

This is a project that I am very excited about. It is a staking dapp, that has been triple audited, and has been developed by the The Paramount Finance team, who are committed to building innovative projects that contribute to shaping the future of DeFi.

They are on a mission to deliver profit-making opportunities within the DeFi space.

The project is DeMountain which was the first ever of its kind to be introduced on the Polygon network, and now they have expanded to the Binance Smart Chain.

So you can either stake Matic, and earn it passively, on the the Polygon chain, or stake BNB on the Binance Smart Chain. For this article I will be focusing on the BNB side.

DeMountain have taken the best functionalities of existing protocols and fine-tuned, and added to them, to bring an exponential profit-making opportunity for early and late entries in the protocol.

The main objective of the protocol is to enter auctions and obtain bMOUNT tokens that can be staked to generate a “mountain of dividends.”

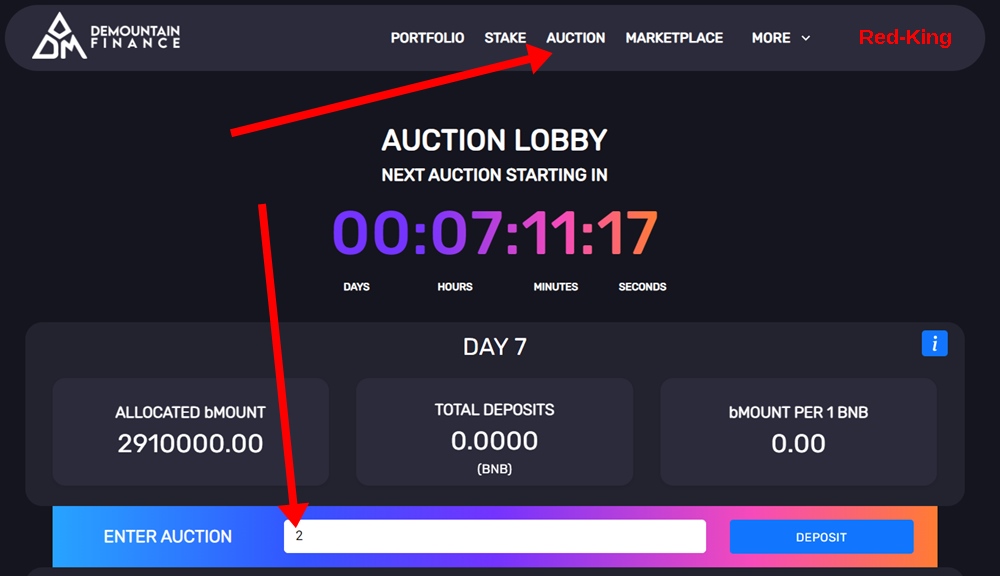

Weekly Auctions

They use a system of weekly auctions to earn tokens that you can stake. In this way it is a bit similar to a few other protocols, but they have a key difference which I think is incredibly clever:

“DeMountain BNB is the first protocol to implement a once-a-week auction system, that by itself will result in FOMO among investors.”

So you can only buy in once a week, and if you miss the buying window you have to wait another week. So the FOMO will be intense.

Auctions will take place every Friday starting at 8:00 PM UTC and will end at 8:00 PM UTC the next day, which means you only have a 24 hour window to enter with BNB and obtain $bMOUNT tokens.

Three million tokens will be minted for the first auction, followed by a decrease of 3% with each next auction.

bMOUNT tokens are distributed to participants at the end of each auction, based on the final bMOUNT per 1 BNB ratio. In the first auction 1 BNB would have earned you 44418.30 bMOUNT tokens.

How it Works

Your first step is to enter the auction. This is where you deposit your BNB and in return you receive bMOUNT tokens. If you enter by using a referral link you receive an additional 1.5% bonus bMOUNT tokens.

At the end of each auction, the tokens are divided up amongst all the investors based on the bMount:BNB ratio.

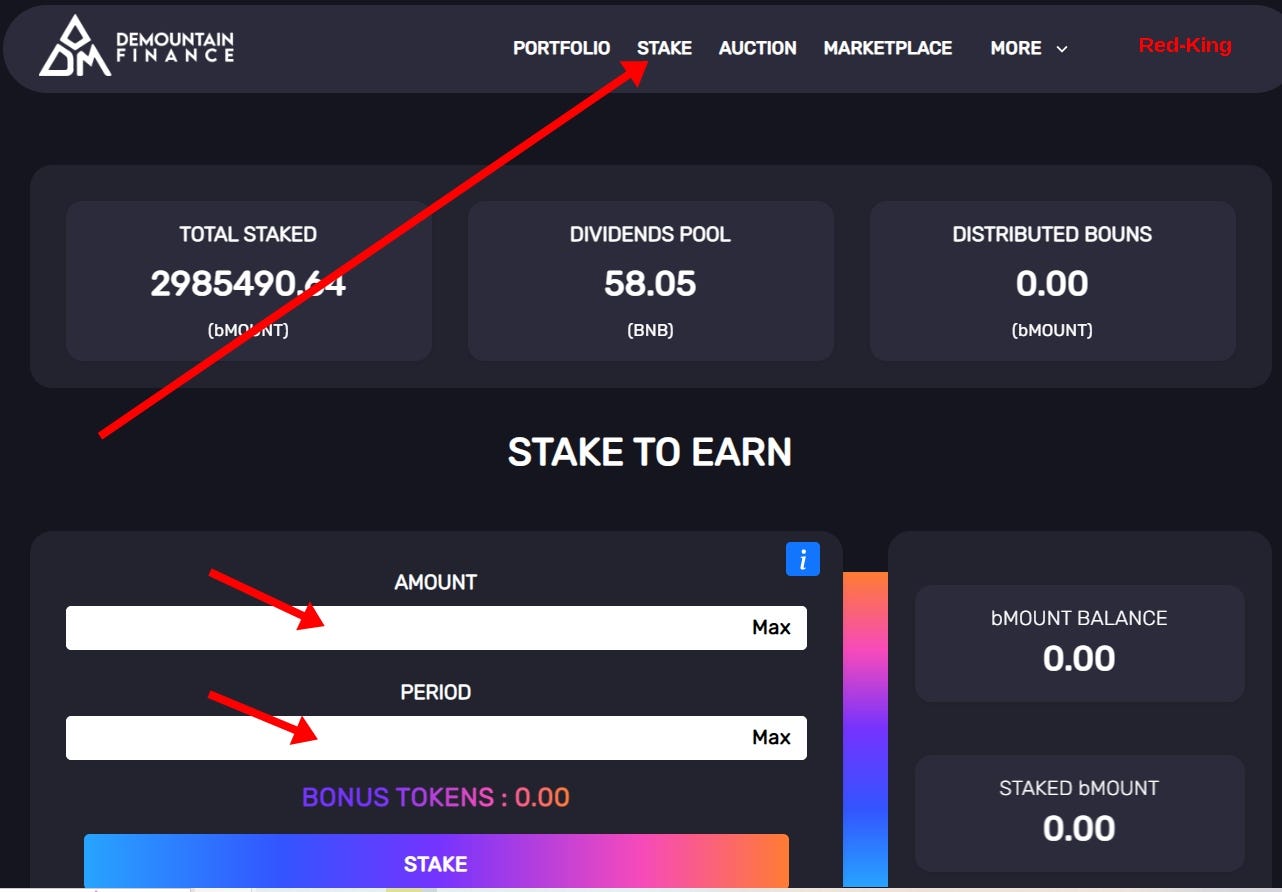

You can then collect those tokens and STAKE them for your chosen period of time (you can stake for between 1 and 300 days — the longer stakes will be rewarded with bonus tokens.). While these tokens are staked they will be earning you BNB dividends completely passively.

Once your staking period ends you receive your BNB rewards AND you receive your bMount tokens back, and you can re-stake them to keep earning more BNB.

*******************************************************************

- You can join my Telegram group here .

- You can see all my articles here.

*******************************************************************

Can You Sell Your Mount Tokens?

If you decide you no longer want to stake your bMount to earn BNB passively you can sell your staked bMount tokens by listing an offer on the marketplace.

In a similar way you can also buy staked bMount tokens in the marketplace.

Collect 1.5% Bonus

When you join via a referral link you earn a 1.5% bonus on your deposit.

To enter on the Polygon Network you can join here.

To enter on the Binance Smart Chain you can join here.

TVL

There is currently 58 BNB in the BSC contract, and over 19000 Matic in the Polygon dividend pool.

Any Unstaking Features?

There’s no unstake function on DeMountain, however you can list your staked tokens for sale within the marketplace, and someone can buy them from you before the staking period ends.

Sustainability

Where does the money come from in order pay out the dividends?

88% of the BNB that enters the auctions goes into the Dividends Pool. The remaining 12% is allocated towards buybacks, lottery, development and marketing.

Will you still get paid if the TVL drops?

The BNB pool will spread the allocated BNB into 8 days starting the first auction, followed by 16 days on the second auction, and 24 days for each following one. So this results in stable dividend payouts regardless of TVL fluctuation.

The BNB will be spread starting the second day after each auction, incentivizing new investors to enter confidently, knowing that there’s a followed-up increase of dividends.

Here’s a detailed breakdown of the dividend allocation:

Loaning and Lending

I love this innovative move. I often hear from potential investors who would love to deposit into a project, but they don’t have the spare funds at the moment.

DeMountain makes it possible by enabling you to get a Matic loan by providing your staked Mount tokens as collateral! Amazing!

Loan requests can be listed within the marketplace.

Audit

Not only have they been audited, but they have been TRIPLE-audited. Audits from three independent firms:

- George Stamp (they received a score of 78!)

- EnCrypto Security

- Haze Crypto

On top of that they have a pending KYC with anonydox.

Extras

Users can compete to beat the TOP ENTRY (which is the largest deposit) and win 30% of the prize pool. The TOP ENTRY will be reduced by 2.5% for each day without a winner.

The team are active on Twitter, Discord and Telegram and you can connect with the devs and other investors there. All the links to their groups are on their website.

In Conclusion…

Everything about the dapp and the team just says “professional”. The more I explore the project the more impressed I become.

While this has been a sponsored article I will also be investing into the project and am hoping it will continue to be successful.

Additional Things to Note:

- You can join my Telegram group here .

- You can see all my articles here.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- This has been a sponsored post.

- These defi projects are all high risk and high reward, only use risk capital and be careful.

- This article contains affiliate links.

- Most of these staking dApps use locked staking which means you can’t take out your original investment.

FOUND THIS HELPFUL?

I hope you found this post to be informative. If you liked the story, please give it some claps (up to 50) and leave a comment below! It will really help me.

I do not get paid by Medium for my articles.

Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

Disclaimer: This is not financial advice, the information in this article is for educational purposes only. Never invest what you can’t afford to lose. I disclaim any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed in my articles. Do Your Own Research.

Don’t have Metamask? Here’s how to set it up

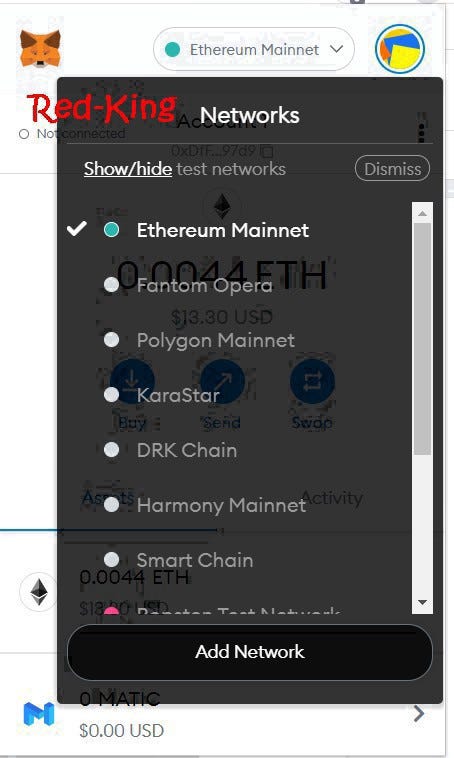

The first thing you want to do is set up a Metamask wallet (if you haven’t done so already). Just open a Chrome or Brave browser and go to metamask.io and click add Chrome extension.

Then you need to add the Binance Smart Chain to your Metamask Wallet.

Click Ethereum in your wallet, then scroll down to Add Network.

Click that and add the following details:

Network Name: Smart Chain

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com