Trusted Team and over $140’000 already in the contract

This is one of the latest projects I’ve invested in. It is a combination of an ROI dapp and a staking platform where you have the option to unstake your investment, which is something I know a lot of investors like.

It pays out at a lower rate than most of the current miners, which arguably means it could be lower risk as well.

It is called Smart Cash Capital and it is a diversified investment fund which operates on the Binance Smart Chain.

What Does That Mean?

It is basically a fund that is broadly invested across multiple market sectors, assets, and/or geographic regions. In this specific project a portion of the allocated fees are being invested in lending protocols, liquidity mining, new defi projects and validator hosting.

How Does it Work?

You stake your investment and, after deducting a 10% deposit fee, your stakes immediately start earning 1% up to 3.5% depending on the duration of each stake. Compounding and withdrawing dividends resets all stakes to level 1 which is 1%.

HOWEVER, creating new stakes on top of existing stakes won’t have any effect on existing stakes

Fees and Taxes

10% staking fee being deducted to the total amount to be staked.

These fees will be used for platform maintenance, marketing and administration fees. There will be no other developers fees aside from deposit fee. In addition, these fees will also be used on building our treasury which will be used for investing into other projects and returns will be injected back into the contract to increase the TVL and payout existing investors.

If the user decides to unstake their staked BUSD, there will be an unstake fee which will be deducted to the total amount to be unstaked. This fees will not go to the developers instead this will stay within the contract and be used as rewards for existing investors.

Is this just a Wealth Mountain knock-off?

The team is pretty outspoken that the code and concept was from the Wealth Mountain project, but how is it different? Let’s begin with the code, the contract has been heavily modified. The potential rugpull/exploit code and flaws of the contract has been removed and fixed. The syntax has been changed to make it easier for other developers to read and basically, we tried to make the contract safe and have minimal owner interaction. The only function that the developer can have granted access post deployment of the contract is the last stake jackpot, which can only be turned on/off.

What is last stake jackpot?

Last stake jackpot is pretty simple, basically, if there is no deposit after 2 hours, the address who last deposited will win the rewards pool and a new round will run.

Rewards pool is capped at 2,000 BUSD. The team believes that this kind of event is good to keeps things interesting for the investors. However, the smart cash capital team decided to put a cap on the rewards so it will not cause much decline in the tvl whenever a winner has been picked and at the same time giving out a good amount of reward for the winner.

The team decided to add this feature to how continuous inflow of investment into the platform.

How is this sustainable?

Sustaining every project is hard, but the team are finding ways on how to make a project live, grow and sustain. Aside from building the treasury, in which will be invested into other projects and earnings will injected back into the project, the team will also do partnerships with other projects and also be accepting development work in which commissions will also be sent to the treasury and be re-invested.

Is the Team Reputable?

Well, the team behind this project has already released multiple projects individually and as a team, aside from that the people behind the project has good track records and has no history of any rugs. Previous project has reached hundreds of thousands and millions in TVL.

Audit

The project has been audited by both George Stamp (received a high score of 89) and Auditoria.

You can check out Smart Cash Capital here.

Remember to only use risk capital — money that you can “afford” to lose. In other words, if the project rugpulls and you lose your investment, it might hurt a bit, but won’t bankrupt you or put you under severe financial pressure. Do your research and enjoy making money.

- My three best investments recently have been have been Furio, Wealth Mountain and the Piggy Bank on Animal Farm.

- You can join my Telegram group here , connect with me on Twitter here and on my brand new YouTube here.

- You can see all my articles here.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

- These defi projects are all high risk and high reward, only use risk capital and be careful.

- This article contains affiliate links.

- Most of these staking dApps use locked staking which means you can’t take out your original investment.

FOUND THIS HELPFUL?

I hope you found this post to be informative. If you liked the story, please give it some claps (up to 50) and leave a comment below! It will really help me.

I do not get paid by Medium for my articles.

Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

Don’t have Metamask? Here’s how to set it up

The first thing you want to do is set up a Metamask wallet (if you haven’t done so already). Just open a Chrome or Brave browser and go to metamask.io and click add Chrome extension.

Then you need to add the Binance Smart Chain to your Metamask Wallet.

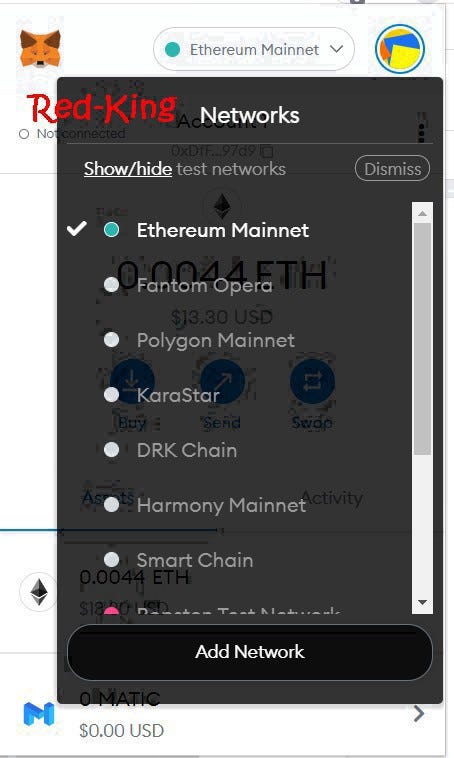

Click Ethereum in your wallet, then scroll down to Add Network.

Click that and add the following details:

Network Name: Smart Chain

New RPC URL: https://bsc-dataseed.binance.org/

ChainID: 56

Symbol: BNB

Block Explorer URL: https://bscscan.com

Disclaimer: This is not financial advice, the information in this article is for educational purposes only. Never invest what you can’t afford to lose. I disclaim any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed in my articles. Do Your Own Research.