This could be the one I’ve been looking for. For those who follow my articles you will know that I have been searching for a decent defi platform that has the potential of longevity, and won’t just pump and dump within a month.

[[ UPDATE: I have now been in the project for a week and am really enjoying it. It gives a minimum of 1.5% every 12 hours, or 3% daily. Withdrawals are instant. ]]

Binance Wealth Matrix (BWM) presents a groundbreaking opportunity for passive income generation, unlike most platforms we’ve seen before. Powered by the unique CLIMB token, exclusively available on the Binance Smart Chain, this DeFi platform offers a truly innovative approach to investment. Through internal Liquidity Pool technology and a focus on frequent reinvestment, BWM creates a sustainable ecosystem where the value of CLIMB token rises with every transaction – and that is the genius part.

It’s only on Day 4 of its inception, so it’s still very early to get in, and so far there is around 12% daily growth of the token. In my opinion there is big potential as the TVL is still relatively low for the potential this has.

First I’ll show you how to get started with your investment, and then I’ll go through all the details of the platform and the CLIMB token.

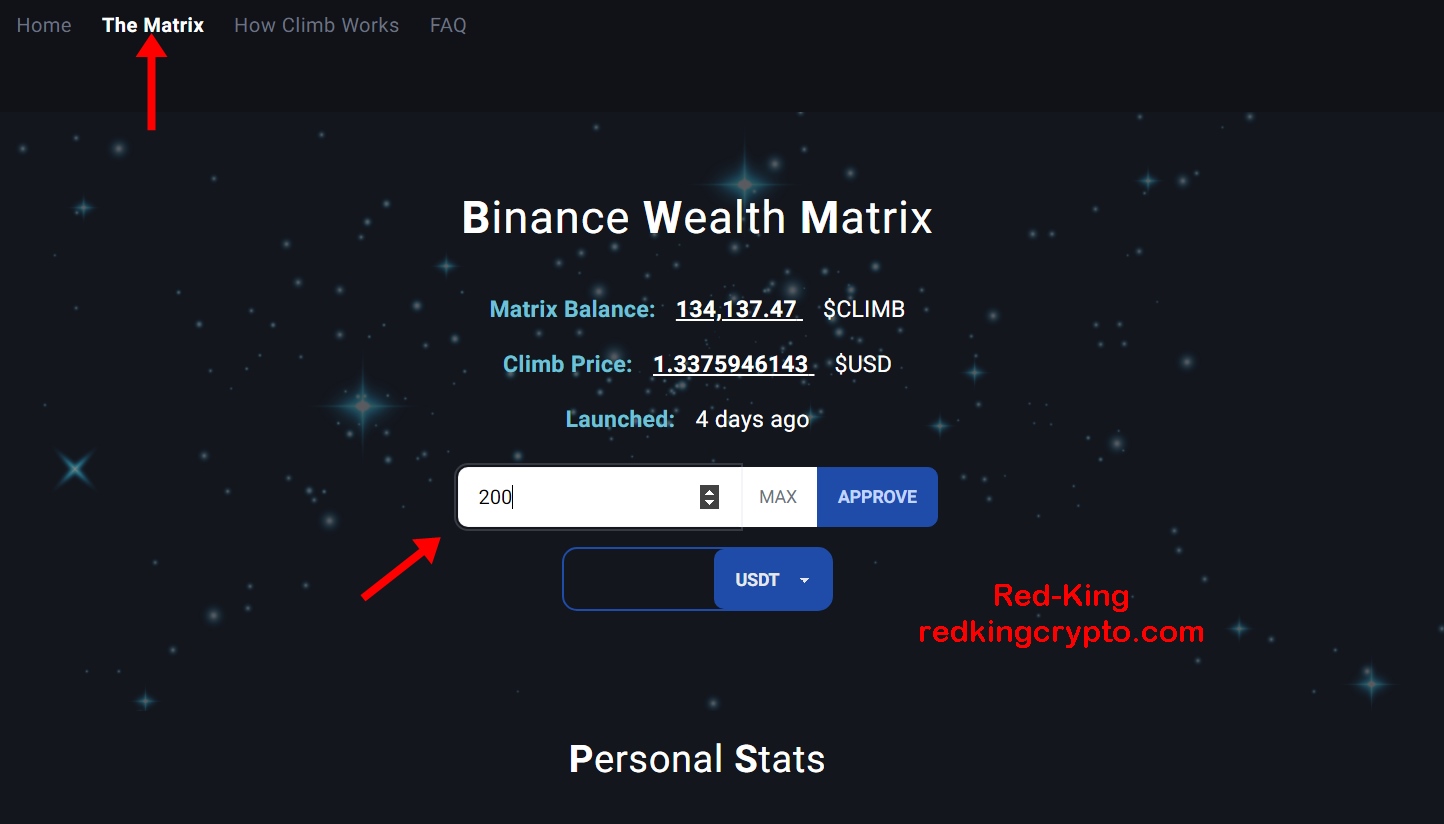

How to Get Started

- Go to the website here.

- Connect your wallet (on the Binance Smart Chain) and make sure you have USDT or BUSD in your wallet. (I top up my MetaMask wallet via Gate and BitGet).

- Insert how much USDT/BUSD you want to invest (see screenshot). You will then need to approve that amount in your wallet, and then confirm the deposit. You might need to refresh the site after “approving” before you can deposit.

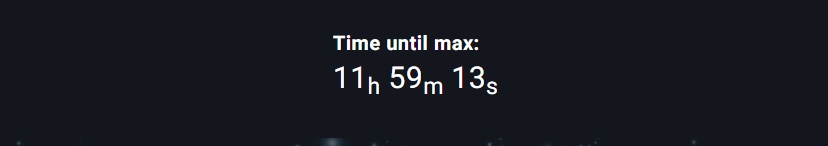

4. Then you will see a timer counting down until your rewards are ready.

HOW CLIMB WORKS

CLIMB tokens work differently than traditional methods of exchanging assets. Instead of using a Liquidity Pool, which connects the token to the backing asset through a market maker system, CLIMB tokens store both assets directly in their own contract.

To buy CLIMB tokens, investors use the dApp and interact with the contract using BUSD or Tether. These contracts are known as “Swapper” contracts and eliminate the need for exchanges.

When the contract receives BUSD or Tether, it exchanges them for the backing asset and mints new CLIMB tokens based on their value. This increases the total supply of CLIMB tokens.

Selling or redeeming CLIMB tokens works the opposite way. The total supply decreases, and the backing asset is converted back into BUSD or Tether, which is then returned to the investor’s wallet.

It’s important to note that the price of CLIMB tokens is not determined by the standard market maker protocol. Instead, a different mathematical equation is used to determine the price and how it changes.

WHAT HAPPENS WHEN CLIMB TOKENS ARE BOUGHT OR SOLD?

The way CLIMB tokens are bought or sold involves a Price-Increase Tax Ratio (PTR) algorithm. This algorithm distributes taxes from purchases and sales to favor the backing asset and increase its value relative to the token supply. The PTR algorithm ensures a consistent increase in CLIMB value regardless of the type of transaction.

PTR (BUYS): When CLIMB tokens are bought, there is a 5% tax, with 4% going towards increasing the price of CLIMB and 1% allocated to the owner’s wallet for expenses and marketing. The buyer receives 95% of the purchased CLIMB tokens at the current value. The proceeds from the purchase are converted to the value equivalent of the backing asset (BUSD or USDT) and added to the contract pool. This causes an increase in the price value of the token, favoring the backing asset.

PTR (SELLS): When CLIMB tokens are sold back to the contract, the seller pays a 5% tax on the received asset. 99% of the sold tokens are destroyed and removed from the total supply. The seller receives 95% of the CLIMB tokens sold at the current value. As a result, the ratio shifts in favor of the asset in the contract, leading to a further increase in CLIMB’s price.

With this equation and tax system, the price value per CLIMB token can never decrease because BUSD and Tether are stable assets. The price only increases with transactions.

The exchange functions used ensure that CLIMB tokens are completely decentralized. There is no need for Liquidity Pool pairings controlled by a centralized entity. The design of the contract improves functionality, return on investment, and investment security for users.

All owner functions in the contracts, except for one, are renounced. The remaining owner function allows for changing the taxes from 5% to a lower percentage, which can be used for marketing promotions. There is no callable owner function that can negatively affect the contract’s functionality or asset value.

WHY CLIMB WILL EXIST EXCLUSIVELY IN THE BINANCE WEALTH MATRIX

CLIMB is designed to exist exclusively in the Binance Wealth Matrix (BWM) to encourage transactions and price growth. If CLIMB were available through a simple Swapper contract without the MATRIX, there would be minimal price action as most investors would buy and hold. The price increases would stagnate quickly after an initial surge of purchases.

By restricting CLIMB to the BWM, investors have the opportunity to reinvest or redeem up to 3% of their total investment per day. Each transaction within the BWM increases the price of CLIMB. Over time, there could be numerous transactions daily, contributing to the continuous price increase of CLIMB.

While each investor’s Total Value Locked (TVL) score fluctuates based on the actions of all investors, the price of CLIMB always rises. The constant increase in CLIMB’s price is expected to offset or eliminate temporary decreases in the contract’s total value.

To stay informed about the latest announcements please make sure you are following me on:

and Telegram.

- I hope you found this post to be informative.

- You can join my Telegram group here or connect with me on Twitter here.

- Follow me on Medium if you want to read more about cryptocurrency, passive income, play to earn games and yield farming.

- I’m not a financial advisor. This is not a financial advice, whatever you read in my articles are strictly for educational purposes.

Disclaimer: This is not financial advice, the information in this article is for educational purposes only. Never invest what you can’t afford to lose. I disclaim any liability or loss incurred by any person who acts on the information, ideas, or strategies discussed in my articles. Do Your Own Research.